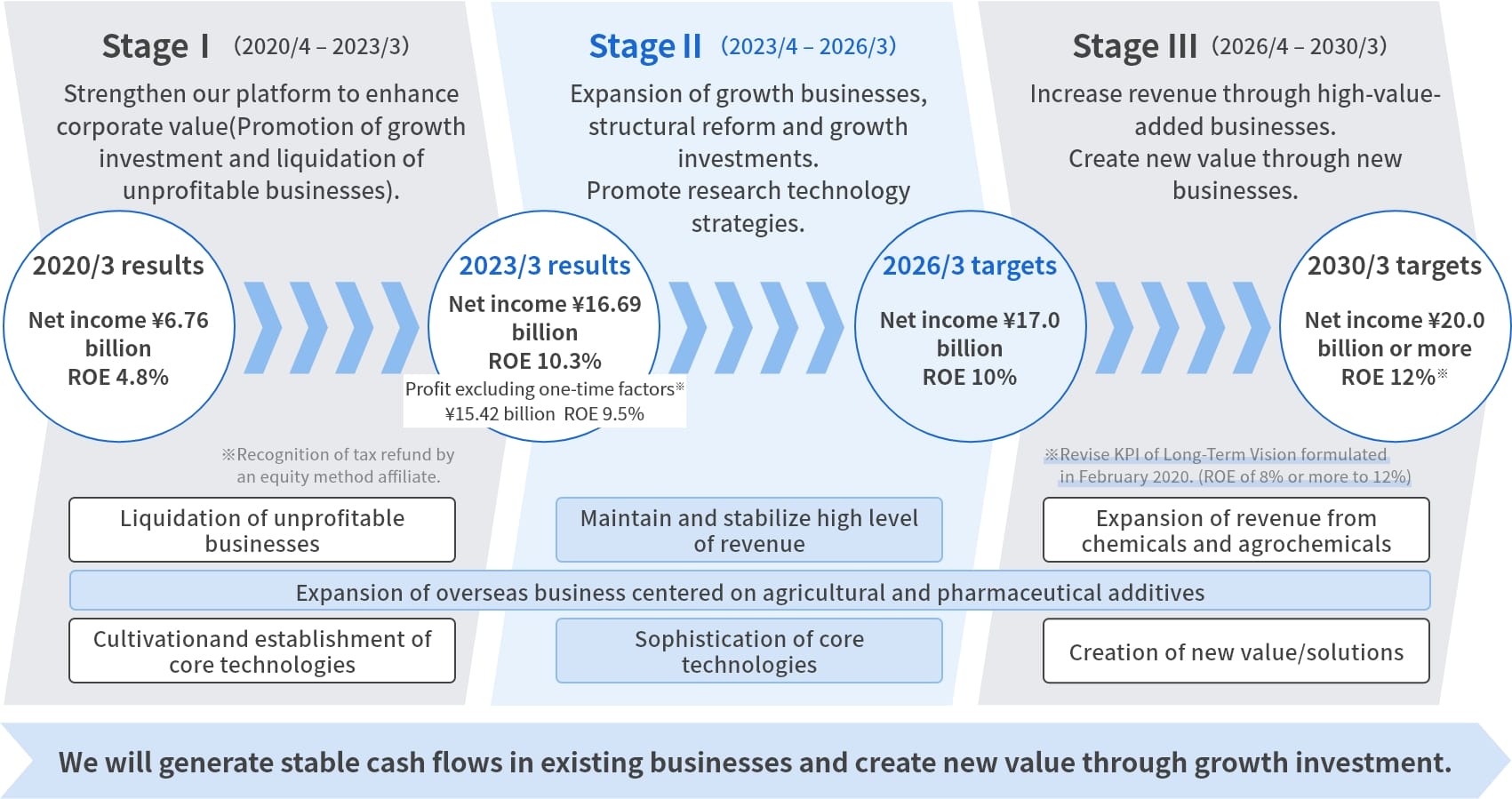

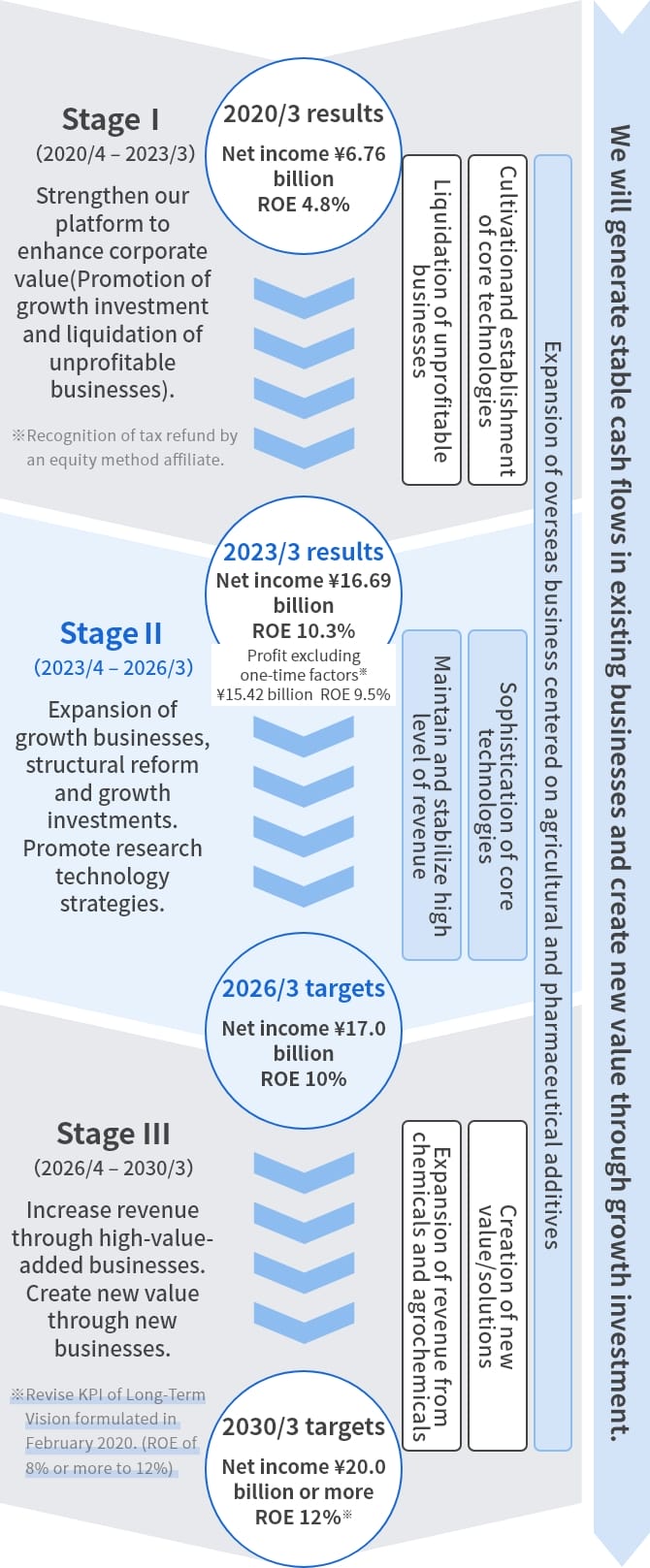

Long-Term Vision /

Medium-Term Business Plan(Overview)

Nippon Soda Group

Long-Term Vision

“Brilliance through Chemistry 2030”

(Fiscal 2021 to Fiscal 2030)

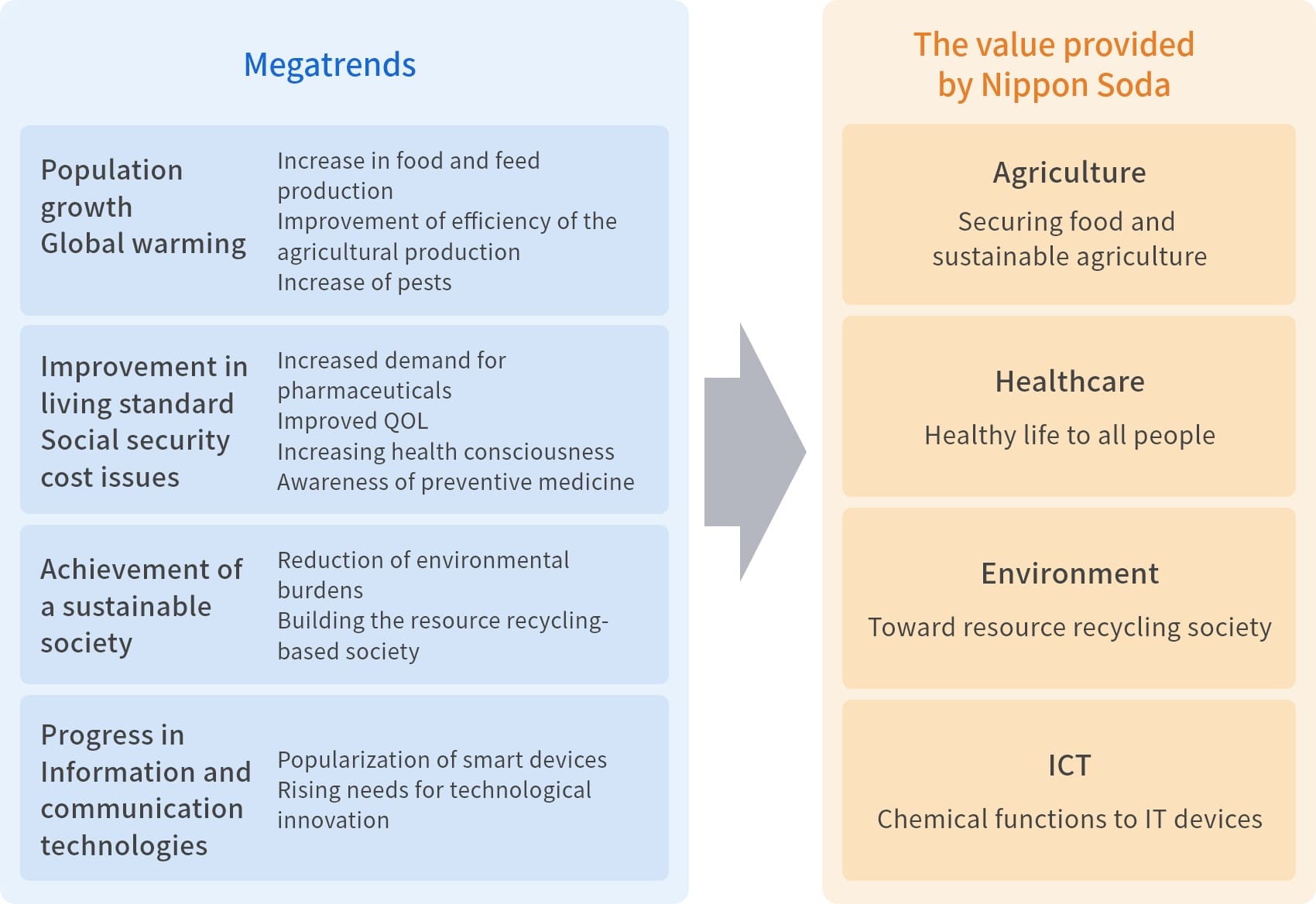

NipponSodaVision

Since its establishment in 1920, Nippon Soda has provided new value to society through chemistry and contributed to the development of society.

The group supports people's everyday lives by delivering a range of chemical products and services to the agricultural, healthcare, environmental, and ICT fields.

NipponSodaMission(Value Creation Process)

Create new value through the power of chemistry and realize increased corporate value through our contributions to society.

Nippon Soda Group Long-Term Vision “Brilliance through Chemistry 2030”

- While accelerating the expansion of our high-value-added businesses and the liquidation of unprofitable businesses, we will promote thorough management streamlining and reform our business portfolio to be resilient toward changes in thebusiness environment and to produce stable earnings.

- While balancing growth investment and shareholder returns, we aim to increase capital efficiency.

KPIsof Long-term Vision “Our Vision 10 Years in the Future” (Revised May 2023)

We aim to implement management focused on investment efficiency aimed at increasing corporate value.

2030/3

| ROS (OP margin) |

10% or more (2020/3 5.6%) |

|---|---|

| ROA (Operating profit ÷ Total asset) |

7% or more (2020/3 3.8%) |

| ROE (Profit ÷ Equity) |

12% (2020/3 4.8%) ↑ Revising “ROE 8% or more” the KPI of the long-term vision formulated in February 2020. |

Basic Strategy

Through growth investments focused on ROI and thorough structural reforms, we will "Implement reforms toward an efficient business structure. -More than doubling our profit margin-"

| Enhancement of cost competitiveness and cost efficiency |

|

|---|---|

| Expansion of overseas businesses |

|

| Promotion of new product development and entry to new businesses |

|

Review of

the Medium-Term Business Plan

“Brilliance through Chemistry Stage Ⅰ”

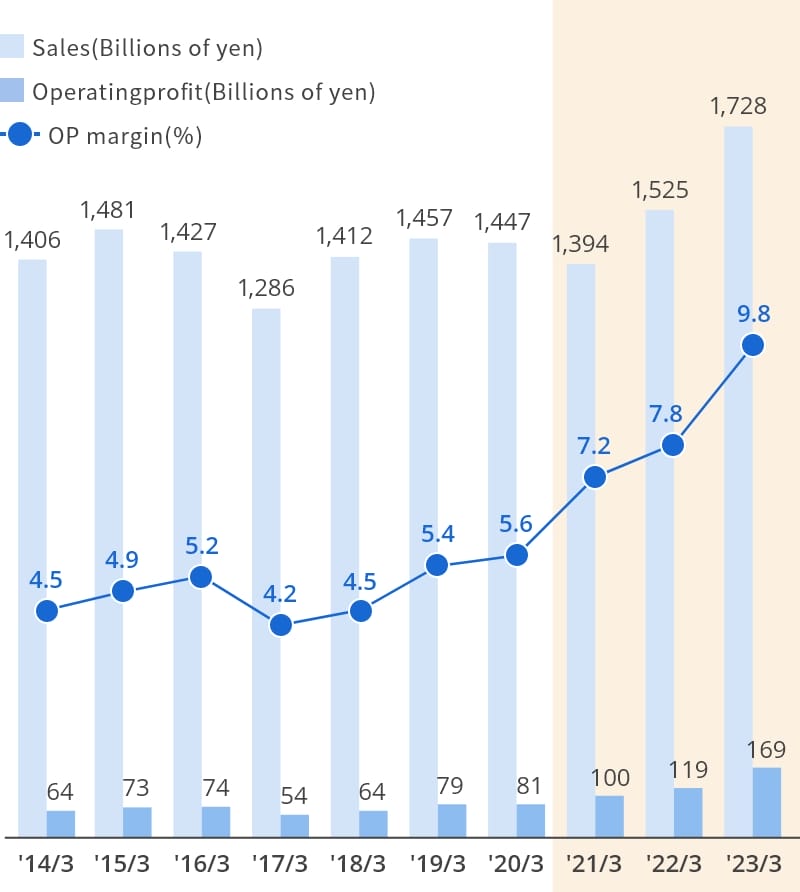

Increased profitability and exceeded numerical targets substantially through expansion of high-value-added businesses and review of our business portfolio.

Implemented proactive investments in products and businesses which increase our cashflow generation capability.

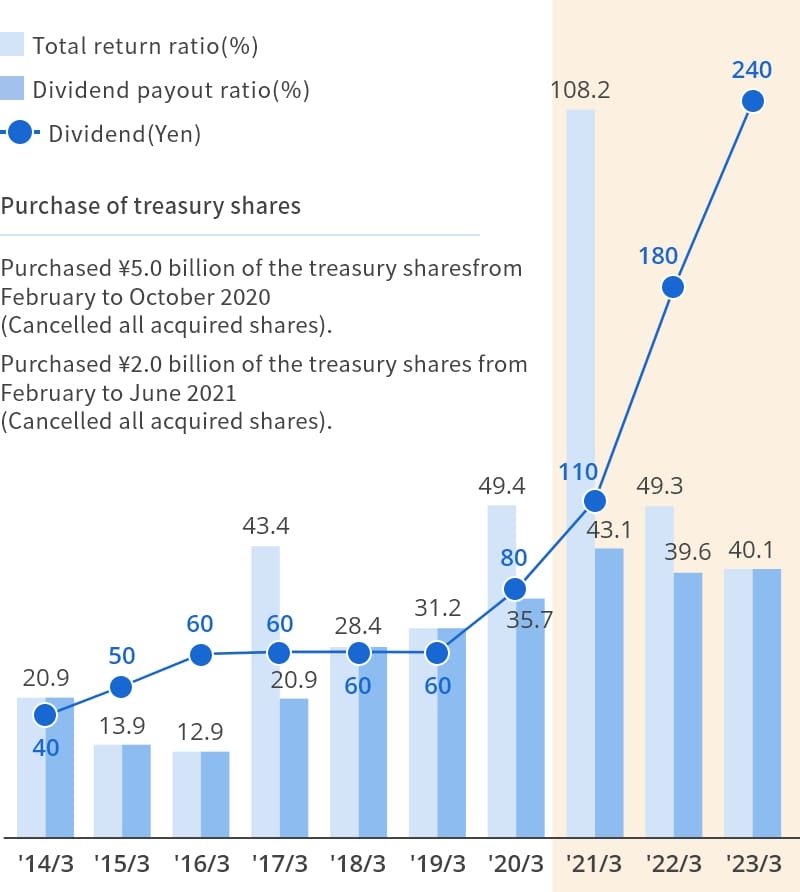

Achieved dividend payout ratio of 40% and increased dividends substantially.

Profit increased as overseas sales of agroproducts grew more than expected and due to the exchange rate for the weak yen changed.

Numerical Targets and Results

| 2020/3 Results |

2021/3 Results |

2022/3 Results |

2023/3 Results |

Target for Stage I (2023/3 Target) |

Long-Term Vision KPI (2030/3) |

|

|---|---|---|---|---|---|---|

| Net profit(Billions of yen) | 6.76 | 7.36 | 12.68 | 16.69 | 7.00Achieved! | - |

| Capital investment(Billions of yen) | 8.82 | 7.72 | 13.11 | 13.26(34.08 / 3years) | 30.00 / 3 yearsAchieved! |

- |

|

Shareholder return Dividend payout ratio(%) |

35.7% | 43.1% | 39.6% | 40.1% | 40%Achieved! | - |

|

Shareholder return Dividend per share(Yen) |

80 | 110 | 180 | 240 | Minimum of ¥80Achieved! | - |

| ROE(%) | 4.8% | 5.1% | 8.4% | 10.3% | 5%Achieved! | 8% or more |

| ROS(%) | 5.6% | 7.2% | 7.8% | 9.8% | 10% or more | |

| ROA(Operating profit÷totalassets) | 3.8% | 4.6% | 5.0% | 6.8% | 7% or more |

Consolidated financial results

*Calculated on the basis of reverse stock split implemented on October 1, 2018.

Shareholder return

*Calculated on the basis of reverse stock split implemented on October 1, 2018.

Target of

the Medium-Term Business Plan

“Brilliance through Chemistry Stage Ⅱ”

Position as “core stage for reform into a highly efficient business structure” and execute various measures to enhance corporate value.

Basic Objectives

- Enhance corporate value through expansion of high-value-added businesses, and structural reform and growth investments that focus on asset efficiency.

- Establish and sophisticate core technologies by promoting research technology strategies, and promote the creation of new businesses.

Capital Policy

- Proactively implement policies that focus on the balance betweengrowth investments and shareholder returns while considering financial soundness.

| Growth investment |

Implement investments in products and businesses which increase our cash flow generation capability.

|

|---|---|

| Increase capital efficiency |

Focus on investment efficiency and appropriately control the balance sheet.

|

| Shareholder return policy |

|

Numerical Target

- Despite the materialization of factors for increased costs, such as rising raw material and fuel prices, we will establish increased profitability in Stage I, which will lead to increased revenue in Stage III, by promoting the continuous improvement of efficiency in each department.

| FY 2026 Numerical Target | ||

|---|---|---|

| Net income | 17.0 billion | FY 2023 16.69 billion (Net income 15.42 billion excluding on-time extraordinary income*) |

| ROE | 10% | FY 2023 10.3% (ROE 9.5% excluding on-time extraordinary income*) |

| Capital investment | Invest ¥40.0 billion over three years (growth investments and investments for maintenance and renewal) |

|

| Shareholder return | Total payout ratio of 50% or more and maintain stable dividends. Implement share buybacks flexibly. |

|

* Recognition of tax refund credit for IHARABRAS, an affiliated company accounted for by the equity method

Exchange rate:¥130/USD,¥140/EUR

Action Plan

| Chemical Materials |

|

|---|---|

| Agri Business |

|

| Other Businesses |

|

| R&D・Production Technology |

|

| Initiatives for Environment and Enhancement of Human Capital |

|

Roadmap of the Long-term Vision

“Brilliance through Chemistry 2030”