Corporate Governance

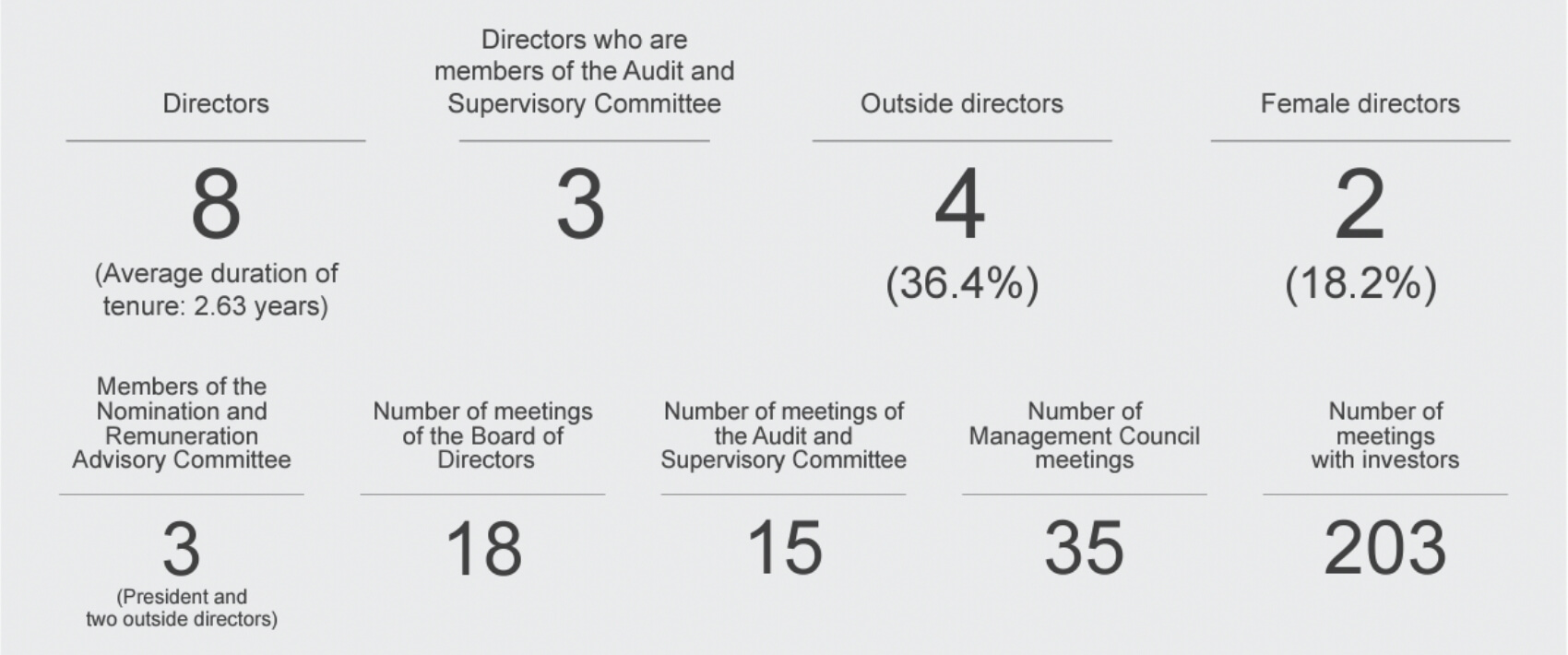

Corporate Governance Highlights

Nippon Soda places primary importance on sound and transparent business management in compliance with the law. Our management philosophy is to contribute to social development by providing superior products through chemistry, to meet expectations from stakeholders, including shareholders, investors, business partners, employees and local communities, and to promote environmentally conscious business practices and activities.

Under this philosophy, we are committed to growing into a technology-oriented group that develops highadded-value products by making best use of its proprietary technologies and expands its business with a global point of view centered on chemistry.

In addition, we recognize that the enhancement of corporate governance is an important management issue for realizing our management philosophy and responding quickly and appropriately to rapid changes in the business environment.

A History of Strengthening Governance

Aiming to Strengthen Governance

- Strengthen management supervision and improve operational agility

- Increase the diversity of the Board of Directors

- Enhance management transparency and fairness

- Strictly comply with laws and regulations and corporate ethics

| FY 2013 | Established CSR Administration Meeting Abolished the executive retirement benefit system |

|---|---|

| FY 2014 | Introduced an executive officer system (number of directors reduced from 14 to 7) Nominated 1 outside director |

| FY 2016 |

Nominated 2 outside directors (increased by 1 person, including 1 woman) Started effectiveness assessment of the Board of Directors |

| FY 2017 |

Reviewed the executive remuneration system (introduced a performance-based stock remuneration plan, board benefit trust (BBT)) |

| FY 2018 | Established Remuneration Advisory Committee |

| FY 2019 | Established Nomination and Remuneration Advisory Committee Utilized external organization for effectiveness assessment of the Board of Directors |

| FY 2021 | Transitioned to a company with an audit and supervisory committee |

| FY 2023 | Reviewed the executive remuneration system (introduced transfer restricted stock remuneration system (RS)) |

Corporate Governance System

The Nippon Soda Group is fully aware of its fiduciary responsibility in accordance with Japan’s Corporate Governance Code and is committed to enhancing its corporate governance structure.

Corporate Governance Structure

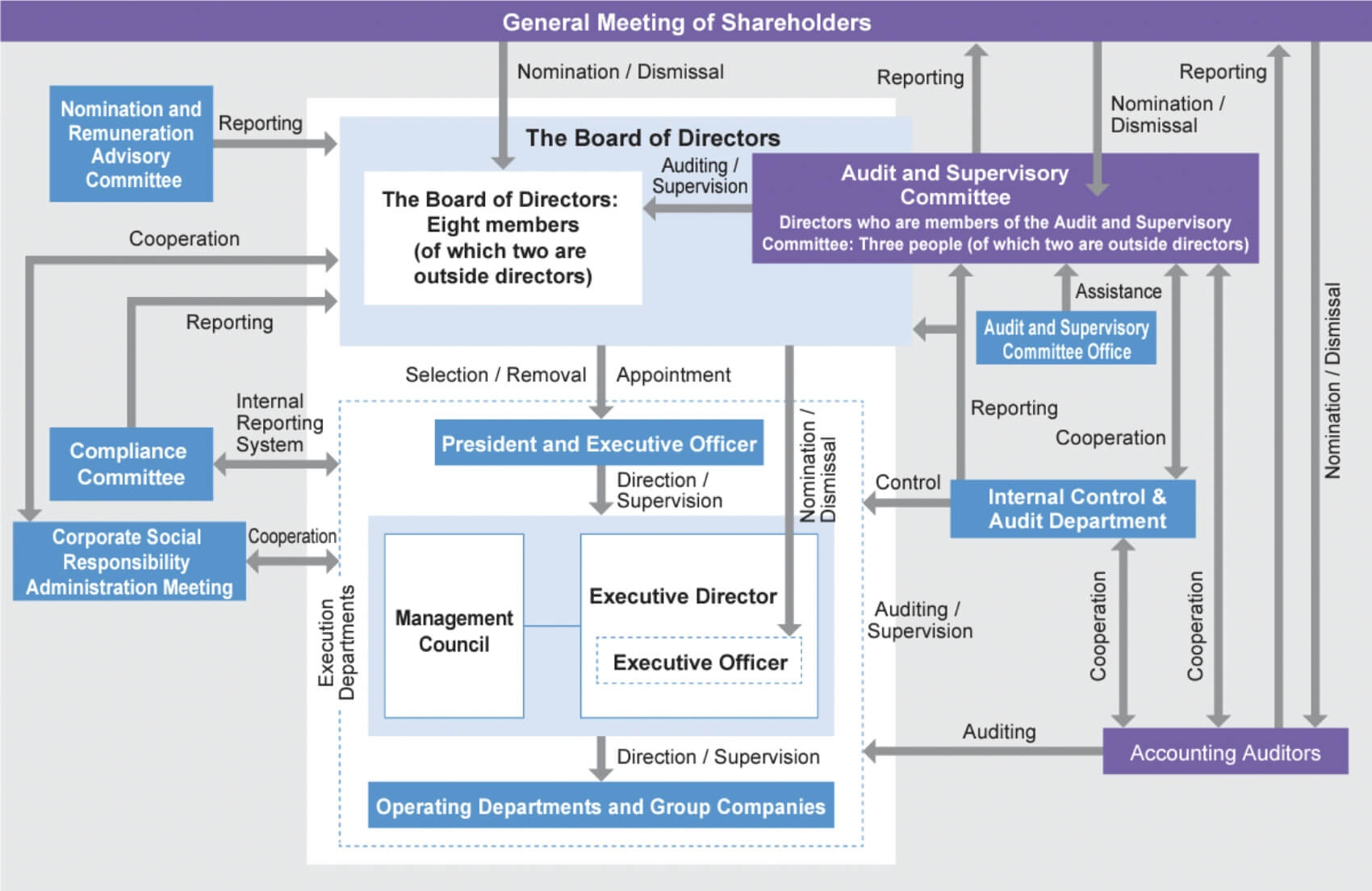

General Meeting of Shareholders

The Nippon Soda Group holds an ordinary general meeting of shareholders in June every year, viewing it as an important opportunity to engage in direct dialogue with our shareholders. We deliver the notice of convocation of the General Meeting of Shareholders at an early date so that our shareholders may acquire a good understanding of the issues that will be reported and the matters for resolution at the shareholders’ meeting.

We also provide pre-delivery disclosure of information on Nippon Soda’s website and at the Tokyo Stock Exchange website, before the notice of convocation of the General Meeting of Shareholders is sent out. Voting rights may be exercised not only in writing but also via the Internet.

Board of Directors

The Board of Directors is responsible for making important management decisions (based on clear standards, such as amounts above a certain level) as stipulated by laws and regulations, the Articles of Incorporation, and the Board of Directors Rules, as well as supervising the execution of each director’s duties. The tenure of directors (excluding directors who are members of the Audit and Supervisory Committee) is set at one year to ensure that they are able to respond quickly to changes in the environment and to clarify their management and operational responsibilities.

Audit and Supervisory Committee

Two of the three directors who are members of the Audit and Supervisory Committee are outside directors. Directors who are also members of the Audit and Supervisory Committee not only attend Management Council meetings, but also inspect important documents (approval requests) and receive explanations of important matters directly from the relevant directors, executive officers, department, or subsidiary in an effort to gain an accurate understanding of corporate information throughout the Group while also monitoring and verifying whether or not related departments are handling and responding to the situation and whether or not internal controls are being legally and appropriately executed. In addition to this, they work closely with the accounting auditors to ensure the reliability of our financial statements, in particular, by receiving regular reports from them and attending some of their on-site audits.

Nomination and Remuneration Advisory Committee

In order to enhance the fairness and objectivity of executive personnel and executive remuneration, we have established a Nomination and Remuneration Advisory Committee consisting of two outside directors and the President. The Committee advises and makes recommendations to the Board of Directors on executive personnel and remuneration.

Management Council

In accordance with the Management Committee Operation Rules, Nippon Soda’s Management Council, consisting of the President, directors who concurrently hold the position of executive officer, and others requested to attend by the President, generally meets once a week (with auditors). It discusses important issues involving business execution other than issues that must be discussed by the Board of Directors, in order to make quick decisions on issues related to business execution.

Compliance Committee

Nippon Soda operates a Compliance Committee, which reports directly to the President, to ensure corporate activities in compliance with laws, regulations and corporate ethics throughout the Group. The Compliance Committee comprises executive officers. At each department, branch, worksite and Group company, a staff member in charge of compliance is appointed.

Corporate Social Responsibility Administration Meeting

Chaired by the President and Executive officer, the Corporate Social Responsibility Administration Meeting serves as the chief Company-wide decision-making body to promote CSR activities, including Responsible Care (RC). Held twice a year, the Corporate Social Responsibility Administration Meeting is attended by all Nippon Soda directors, executive officers, plant managers, and officers from our main domestic Group companies. Through these meetings, management set CSR targets, assess results, and revise the targets as necessary to ensure continuous improvement in line with the PDCA cycle.

Director Nomination Policy

Decisions on the nomination of director candidates and the selection and dismissal of senior management are made by resolution of the Board of Directors based on the advice and recommendations of the Nomination and Remuneration Advisory Committee. Also, candidates for the position of director who are members of the Audit and Supervisory Committee are determined by the Board of Directors after obtaining approval from the Audit and Supervisory Committee.

To ensure that they are suitable for their responsibilities, candidates for directors and senior management are selected in accordance with the following criteria:

- (1)Extensive business experience

- (2)Excellent managerial sense

- (3)Leadership, drive and planning skills

- (4)Proper character and insight

- (5)Healthy in body and mind

Candidates for outside directors are nominated in accordance with the requirements of the Companies Act and the Tokyo Stock Exchange, and include those with expertise and extensive experience who can be expected to provide constructive and candid views and comments on the Company’s management.

In the event of any impropriety or significant violation of relevant laws, regulations or the Articles of Incorporation in the performance of duties by senior management, or any other reason that makes it difficult for them to properly perform their duties, they shall be removed from their position.

Outside Directors

Nippon Soda has four highly independent outside directors (including two directors who are also members of the Audit and Supervisory Committee) in an effort to enhance the ability of the Board of Directors to contribute to the Company’s sustainable growth and to increase medium- and long-term corporate value. Regarding independent outside directors, in accordance with the requirements of the Companies Act and the Tokyo Stock Exchange regarding independence, the Company nominates individuals who are unlikely to have conflicts of interest with general shareholders and who are able to ensure objectivity and rationality in the Company’s decision-making and contribute to increasing corporate value. Specifically, none of the following must apply to the person:

- (1)A person who does business with the Company or its subsidiaries as a principal customer or an executive thereof

- (2)A primary business partner of the Company or its subsidiaries or an executor of such business

- (3)A consultant, certified public accountant, lawyer or other professional who has received a large amount of money or other assets from the Company or its subsidiaries in addition to director’s remuneration

- (4)A person who has fallen into any of the above categories (1) to (3) in the past year

- (5)The spouse or a relative within the second degree of kinship of the following persons:

- 1.a person who falls under (1) to (4) on the left

- 2.a person who is, or has been in the past one year, an executive of the Company or its subsidiaries

- 3.a person who is currently, or has been in the past one year, a non-executive director of the Company or a subsidiary of the Company

Skills Matrix

At the Nippon Soda Group, the mission we have set in our long-term vision (FY 2021–FY 2030) is to “Create new value through the power of chemistry and increase corporate value by contributing to society.” To achieve this mission, and to ensure appropriate and quick decision-making on important management matters such as basic strategies, capital policies, and sustainability management, as well as supervision of directors’ execution of duties, we have identified the skills required of the Board of Directors as below.

These required skills will be revised as necessary in line with changes in external environments and internal conditions.

| Directors | Specialist expertise and experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Gender | Position | Director tenure |

Corporate management |

Finance/ accounting |

Business strategy/ portfolio |

R&D/ production technology |

Internationality | ESG/ sustainability |

Legal affairs/ risk management |

| Akira Ishii | Male | Director Chairman (Representative Director) |

13 years | ● | ● | |||||

| Eiji Aga | Male | Director President (Representative Director) |

2 years | ● | ● | ● | ||||

| Atsuo Watanabe | Male | Director Executive Managing Officer |

New appointment |

● | ● | |||||

| Osamu Sasabe | Male | Director Managing Officer |

1 year | ● | ● | |||||

| Osamu Shimizu | Male | Director Managing Officer |

New appointment |

● | ● | ● | ||||

|

Mitsuaki Tsuchiya

Outside

Independent

|

Male | Director | 2 years | ● | ● | |||||

|

Yuko Watase

Outside

Independent

|

Female | Director | New appointment |

● | ● | ● | ||||

| Nobuyuki Shimoide | Male | Director | 3 years | ● | ● | |||||

| Nobuyuki Hori | Male | Director Audit and Supervisory Committee member (Full-time) |

New appointment |

● | ● | |||||

|

Yoko Waki

Outside

Independent

|

Female | Director Audit and Supervisory Committee member |

2 years | ● | ||||||

|

Hayato Yoshida

Outside

Independent

|

Male | Director Audit and Supervisory Committee member |

New appointment |

● | ● | |||||

Reasons for Appointment of Outside Directors

| Name | Attendance at meetings of the Board of Directors and the Audit and Supervisory Committee |

Reason for nomination | |

|---|---|---|---|

| Board of Directors (18 meetings) |

Audit and Supervisory Committee (15 meetings) |

||

| Mitsuaki Tsuchiya | 18 times | ― | We believe that by having him apply the knowledge and experience he has gained over many years in the banking business and his involvement in the management of other companies, he will be able to further strengthen the Company’s management structure. |

| Yuko Watase | (New appointment) | ― | We believe that she can use her specialist expertise and international experience in accounting audits as a certified public accountant, as well as her long-term involvement in work related to cross-border M&As and business portfolio strategies, to help reinforce the Company’s governance and contribute to its sound growth and development. |

| Yoko Waki | 18 times | 15 times | Although she has never been directly involved in corporate management, we believe that she can use her extensive knowledge and insight on corporate law as an attorney and her experience as an outside director of other companies to audit the Company’s management. |

| Hayato Yoshida | (New appointment) | (New appointment) | Although he has never been directly involved in corporate management, we believe that he can use his abundant experience and advanced expertise in corporate accounting as a certified public accountant, as well as his international experience and other wide-ranging knowledge, to audit the Company’s management. |

Executive Remuneration

Policy on decisions

Nippon Soda’s executive remuneration is determined based on a balance of common practices, company performance and employee salaries. A resolution was passed on June 26, 2020, at the 151st Ordinary General Meeting of Shareholders to set the total amount of remuneration for directors (excluding directors who are members of the Audit and Supervisory Committee) and directors who are members of the Audit and Supervisory Committee at no more than ¥350 million and no more than ¥100 million per year, respectively.

Director remuneration shall be determined within the limits of the total amount of remuneration approved by the General Meeting of Shareholders, and shall be discussed and decided by the Board of Directors based on the advice, recommendations and findings of the Nomination and Remuneration Advisory Committee. The Board of Directors entrusts decisions regarding directors’ basic remuneration, as well as directors’ (excluding outside directors’) performance-linked remuneration, evaluation remuneration, and stock-based remuneration, to the Representative Director and President. We believe that the representative directors are most suited to evaluating the departments of each director while considering overall business performance and other factors. The appropriateness of decisions made regarding remuneration are confirmed in advance by the Nomination and Remuneration Advisory Committee.

Executive remuneration for FY 2022 was discussed by the Nomination and Remuneration Advisory Committee on June 23, 2021. Based on their findings, director remuneration and share benefit trust points were discussed and determined at the Board of Directors’ Meeting on June 23, 2021. Audit and Supervisory Committee member remuneration was determined following discussions at an Audit and Supervisory Committee meeting, within the total amount of remuneration approved by the General Meeting of Shareholders.

Following confirmation that methods for determining remuneration were in line with the decision policy, that the resulting remuneration conformed to the decision policy discussed at the Board of Directors’ meeting, and that the findings of the Audit and Supervisory Committee were respected, we have determined that individual director remuneration for FY 2022 is in line with the decision policy.

As stipulated in the Articles of Incorporation, the number of directors (excluding those who are members of the Audit and Supervisory Committee) is limited to 10, and the number of directors who are members of the Audit and Supervisory Committee is limited to five.

Total Amount of Remuneration

| Classification | Total amount of remuneration (Millions of yen) |

Total amount of remuneration by type (Millions of yen) | Number of eligible persons |

||

|---|---|---|---|---|---|

| Basic remuneration |

Performance- linked remuneration |

Stock-based remuneration |

|||

| Directors(excl. Audit and Supervisory Committee members) (Outside directors) |

252 (21) |

153 (21) |

83 (-) |

16 (-) |

9 (2) |

| Directors(Audit and Supervisory Committee members) (Outside directors) |

49 (21) |

49 (21) |

- (-) |

- (-) |

3 (2) |

| Total (Outside directors and outside auditors) |

302 (43) |

203 (43) |

83 (-) |

16 (-) |

12 (4) |

- *1 The above remuneration is based on the executive remuneration system used up until the 153rd Ordinary General Meeting of Shareholders held on June 29, 2022, when it was determined that the executive remuneration system would be revised.

- *2 The above number of persons and amount of remuneration includes that of one director who retired on June 29, 2021, due to the expiration of their term of office.

- *3 The above performance-linked remuneration has been calculated using the following formula and indices that show results and achievements from this fiscal year.

Prior-fiscal year performance-linked remuneration + Adjustment of performance-linked remuneration for the current fiscal year*

※Adjustment of performance-linked remuneration for the current fiscal year: Calculations are based on two indices: Increase/decrease in consolidated ordinary profit and increase/decrease in non-consolidated operating margin.

These two indices measure the level of achievement of consolidated and non-consolidated business results. As they are appropriate indices to evaluate the achievements and level of contribution of each executive, they have been selected as indices for performance-linked remuneration.For executives of sales departments, in addition to these indices, the performance of their relevant departments are also taken into consideration.

Increase/decrease in consolidated ordinary profit and increase/decrease in non-consolidated operating margin for FY 2022 were as follows:

・ Increase/decrease in consolidated ordinary profit ¥3,768 million

・ Increase/decrease in non-consolidated operating margin 17.2% - *4 For the above stock-based remuneration, we have introduced a Board Benefit Trust system. BBT works on a position-based points system, and points are awarded using the following formula.

Formula: Standard points based on position x Index coefficient for the current fiscal year

Index coefficient for the current fiscal year is determined within a range of 0% to 150% using a matrix table with the following two indices: ROE for the current fiscal year and increase/decrease in consolidated operating profit (the amount of increase/decrease in the current fiscal year’s actual results compared to the average of the previous three years). The results for each index in FY 2022 were as follows:

・ROE 8.4%

・Increase/decrease in consolidated operating profit ¥3,256 million

Revision of remuneration system

We have revised our executive remuneration system to further promote the sharing of value with our shareholders and boost incentive among executives to improve our corporate value. At the 153rd Ordinary General Meeting of Shareholders held on June 29, 2022, a resolution was passed to introduce a transfer restricted stock remuneration system and, based on this system, to pay directors (excluding directors who are members of the Audit and Supervisory Committee, outside directors, and part-time directors) a monetary remuneration claim equivalent to the amount to be paid for transfer restricted stock. Further, in line with the approval of this system, we abolished the Board Benefit Trust stock-based remuneration system as of the conclusion of the above Ordinary General Meeting of Shareholders.

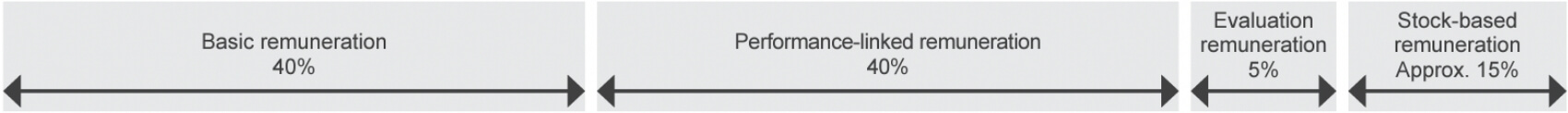

Individual director remuneration consists of (1) basic remuneration, (2) performance-linked remuneration, (3) evaluation remuneration, and (4) stock-based remuneration, the ratios of which are shown in the following table (Overview of Decision Policy on Individual Remuneration: (e) Decision policy on ratio of remuneration by type). Note that outside directors, part-time directors, and directors who are members of the Audit and Supervisory Committee are paid only basic remuneration and are not subject to performance evaluation.

Overview of decision policy on individual remuneration(Revised remuneration system)

| a. Decision policy on basic remuneration | The amount is determined based on the role and position of the director. | ||||||

|---|---|---|---|---|---|---|---|

| b. Decision policy on performance-linked remuneration | Calculated by the following formula, using an index that shows the results and performance of the current fiscal year Policy on decisions〈formula〉 Prior-fiscal year performance-linked remuneration + Adjustment of performance-linked remuneration for the current fiscal year*1 + Performance-linked amount for the current fiscal year*2

|

||||||

| c. Decision policy on evaluation remuneration | Calculated based on the level of achievement of the targets set by each officer at the beginning of the term. | ||||||

| d. Decision policy on stock-based remuneration | In addition to further sharing value with our shareholders, we have introduced a transfer restricted stock remuneration system (RS) as an incentive linked to the medium- to long-term improvement of our corporate value. Through this system, a certain quantity of transfer restricted stock is granted to each position depending on their roles and responsibilities. | ||||||

| e. Decision policy on ratio of remuneration by type | Approximate ratios Basic remuneration: Performance-linked remuneration: Evaluation remuneration: Stock-based remuneration 40%: 40%: 5%: 15%  |

||||||

| f. Decision policy on period and conditions of remuneration | Fixed monthly remuneration includes basic remuneration, performance-linked remuneration, and evaluation remuneration. For transfer restricted stock remuneration, which is non-monetary remuneration, transfer restricted stock is granted every year based on an allotment agreement. Transfer restrictions are lifted when an executive retires or resigns from their final position in the Company. | ||||||

| g. Decisions on individual remuneration | Based on decisions by the Board of Directors regarding basic remuneration, performance-linked remuneration, evaluation remuneration, and stock-based remuneration, decision-making authority on individual remuneration belongs to the President. To ensure that this authority is appropriately exercised, prior to making a decision on the relevant amount, the President briefs and holds discussions with the Nomination and Remuneration Advisory Committee and seeks their approval. |

Effectiveness Assessment of the Board of Directors

At Nippon Soda, to improve the Board of Directors’ decision making on appropriate execution of duties and to strengthen their supervisory functions, since FY 2016, all directors have been asked to complete selfassessments in the form of questionnaires. We also regularly commission an external organization to conduct interviews and analyze and assess the results. Most recently, these interviews were conducted in FY 2019 and FY 2022. In FY 2022, questionnaires put together by the external organization and comprising the topics below were given to all directors, including directors who are Audit and Supervisory Committee members. Based on these results, the external organization held interviews with all directors, and the Board of Directors examined and discussed current conditions in line with the details of these interviews.

(Survey topics)

- ①Board of Director functions (enhancement of discussions on medium- to long-term management strategies and fulfillment of supervisory functions for matters related to nomination and remuneration)

- ②Board of Director composition and size (number of directors and independent outside director ratio, and level of skill and diversity)

- ③Operation of the Board of Directors (number of meetings, frequency, time; provision of materials; meeting proceedings, etc.)

- ④Supervision of auditing functions (Audit and Supervisory Committee members’ and outside directors’ collaboration with auditing bodies, etc.)

- ⑤Outside directors’ performance of functions (creation of systems to help outside directors perform their functions, provision of information to outside directors, etc.)

- ⑥Relationship with shareholders and investors (systems for dialogue with shareholders and investors, shareholder and investor feedback on Board of Directors, etc.)

As a result, overall, it was confirmed that the Board of Directors was functioning effectively. Regarding Board of Director composition, it was found that the Board of Directors possesses the necessary skills and diversity to realize the Company’s management strategies, and that an appropriate environment is in place for healthy discussions and other board proceedings. Among its other strengths, the Board of Directors was also found to promote the open provision and sharing of information to outside directors in order to enable their active participation in discussions. However, issues were found regarding the further enhancement of discussions on medium- to long-term management strategies and the reinforcement of supervisory functions for matters related to nomination and remuneration.

We will continue to find ways to improve the operation of the Board of Directors and further enhance its effectiveness.