Message from the President

Achieving Powerful, Flexible Growth across the Next Century to Bring About a Sustainable Society and Sustainable Development

Representative Director, President Eiji AgaProgress and Achievements of

Long-term Vision

Stage Ⅰ

It has now been one year since I assumed the role of representative director and president in April 2021. In addition to the prolonged effects of the pandemic, our business environment has been impacted by Russia’s invasion of Ukraine and also by economic friction between the US and China, and as a result the future remains uncertain. Despite these extraordinary circumstances, at the Nippon Soda Group we have implemented a range of measures with full force to improve our corporate value and achieve the targets in our long-term vision, Brilliance through Chemistry 2030 (FY 2021FY 2030), and our medium-term business plan, Brilliance through Chemistry Stage Ⅰ (FY 2021–FY 2023). Thanks to our resolve to come together and overcome these crises in the face of uncertainty, in FY 2022 net sales totaled ¥152.5 billion (up 9.5% year on year), operating profit came to ¥11.9 billion (up 19.5% year on year), ordinary profit stood at ¥16.5 billion (up 29.6% year on year), and net profit was ¥12.7 billion (up 72.3% year on year). External factors such as a weak yen helped drive this success, and while results may have exceeded our actual capabilities, I also believe that our repeated communication to employees of the significance and purpose of our long-term vision and medium-term business plan contributed to these excellent achievements.

Solidifying Our Foundations to Improve Corporate Value

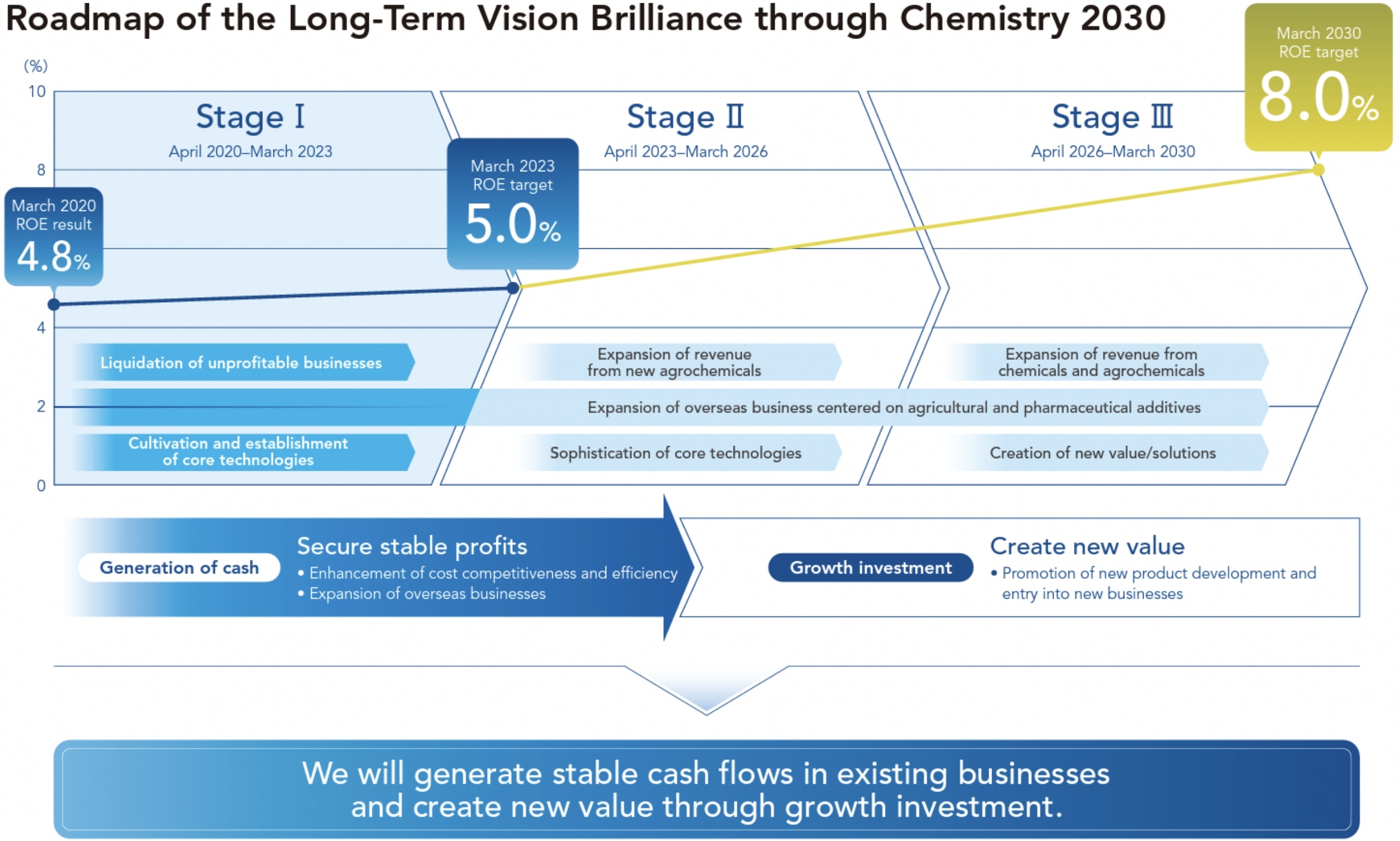

The mission of the Nippon Soda Group is to “Create new value through the power of chemistry and increase corporate value by contributing to society.” To fulfill this mission, we have formulated a roadmap comprising three medium-term business plans (Stages Ⅰ to Ⅲ) and we are gradually moving forward with the relevant initiatives. We have positioned Stage Ⅰ as the first step toward achieving our longterm vision and are working to solidify our foundations to improve corporate value. For the three-year period of Stage Ⅰ (FY 2021–FY 2023), we are placing particular focus on three areas: (1) the liquidation of unprofitable businesses; (2) the expansion of overseas business centered on agricultural and pharmaceutical additives; and (3) the cultivation and establishment of core technologies.

For the liquidation of our unprofitable businesses, we have withdrawn from the electrolysis business related to caustic potash—a sector we have operated since 1929 at the Nihongi Plant—and will only continue sales of caustic potash, potassium carbonate, and other related products for as long as inventory lasts. This structural reform no doubt caused mixed feelings among employees on the frontline, and for me personally it was an agonizing decision. Fortunately though, increased production capacity for our pharmaceutical additive NISSO HPC and the new construction of a mass-production plant for our new fungicide MIGIWA (ipflufenoquin) have ensured that our portfolio shift has started well. Now and again, investors ask us whether we are being hindered by a conglomerate discount due to the number of businesses we operate relative to the scale of our organization. However, we believe that operating multiple highly profitable and competitive growth businesses can play a major role in improving corporate value in today’s era of uncertainty. As such, we will continue with our strategy of liquidating our unprofitable segments and pouring our resources into the expansion of high-addedvalue businesses.

Our efforts to expand our overseas businesses are centered on agrochemicals and pharmaceutical additives. In agrochemicals, our main insecticide MOSPILAN (acetamiprid) is seeing significant sales growth, thanks to the expiration of

registrations, and restrictions on the use, of competing products in Europe. Moreover, due to its minimal environmental impact, MOSIPLAN (acetamiprid) was assessed for re-registration in the EU, and its validity was extended to 2033. As such, we believe the product will maintain its superiority for years to come. Among our other efforts to expand our overseas businesses, in India we acquired shares of the agrochemical manufacturing and sales company Bharat Certis Agriscience Ltd. In addition to promoting sales of existing agrochemicals, our aim is to begin sales of new agrochemicals in a few years’ time. We are also focusing on increasing sales and overseas expansion of the three new agrochemicals we have recently launched to market—the fungicide PYTHILOCK (picarbutrazox), the acaricide DANYOTE (acynonapyr), and the fungicide MIGIWA (ipflufenoquin)—and look forward to their future growth. For our pharmaceutical additives, we are working on global expansion of NISSO HPC and are making faster-than-expected progress. Although we completed work to increase production capacity for NISSO HPC in July 2021, strong demand has seen sales grow quicker than we expected, mainly for export, and so we are examining further work to increase production capacity. Further, as one measure to expand peripheral businesses, we purchased a business in sodium stearyl fumarate (SSF), which is used as a lubricant in the manufacture of pharmaceutical tablets. Using this alongside NISSO HPC will allow us to formulate tablets with active ingredients that are difficult to mold. In the future, we hope to make use of the synergy between these two products in various pharmaceutical tablets.

Among our efforts to cultivate and establish core technologies, we are implementing strategies to develop personnel who can learn, use, and promote the latest technologies, as we aim to drive the digitalization of our research and development processes, by making use of materials informatics* and other data science approaches. Among our new initiatives, in line with the Sustainable Food Systems Strategy “MeaDRI” put together by the Ministry of Agriculture, Forestry and Fisheries, we are exploring the use of reduced-risk agrochemicals, developing biopesticides and biostimulants, examining compatibility with drone-based applications, and taking on other cutting-edge projects.

Looking ahead, we will work to create new value in the four fields we have identified as materialities—agriculture, healthcare, the environment, and ICT—and in turn contribute to solving social issues and increasing corporate value.

Our management targets for FY 2030, the final year of our long-term vision, are as follows: Achieve more than 10% in ROS (operating profit on sales), more than 7% in ROA (operating profit on assets), and more than 8% in ROE (return on equity). In FY 2022, we achieved our target of more than 8% in ROE with 8.4%, but this figure minus extraordinary income from the exchange of subsidiaries’ and affiliates’ stock was 7.2%. Further, at 7.8% and 5.0% respectively, we are making steady progress toward our targets for ROS and ROA. Regarding shareholder returns, we achieved a dividend payout ratio of 39.6% with an annual dividend of ¥180 per share. Further, we purchased ¥5 billion and ¥2 billion of treasury shares in 2020 and 2021, respectively, and will continue to do so as a means to supplement our shareholder returns.

In the Chemicals Business, sales increased in fine chemicals, pharmaceuticals, industrial fungicides, industrial chemicals, and specialty chemicals. In fine chemicals, sales increased thanks to growth in color developers for thermal paper and specialty isocyanates. In pharmaceuticals and industrial fungicides, we saw an increase in sales of NISSO HPC and pharmaceutical ingredients. For industrial chemicals, although sales of caustic potash fell due to structural reform, overall sales increased thanks to growth in caustic soda and rising sales prices of phosphorous chloride brought on by skyrocketing raw material prices. Meanwhile, sales also grew in specialty chemicals thanks to increases in VP-POLYMER, a semiconductor photoresist material, and the resin additive NISSO-PB. In the Agro Products Business, although exports of herbicides and fungicides decreased, an increase in exports of insecticides and

acaricides and sales of our new proprietary agrochemicals ensured that sales grew overall. In the Trading Business, we saw an increase in sales and profit thanks to growth in our organic and inorganic chemical products, nonferrous metals, urethane materials, and others. Our Transportation and Warehousing Business and Construction Business also performed strongly.

In FY 2023, we anticipate net sales of ¥162.0 billion, operating profit of ¥12.3 billion, ordinary profit of ¥16.5 billion, and net profit of ¥11.0 billion, while we are also planning for an annual dividend of ¥180 per share as in the previous year. We will continue to ensure appropriate shareholder returns in line with growth in profit.

- *A field of study in which informatics methods that utilize statistical analysis, etc., are used to search for new materials from a large amount of data

Growth Strategies and Prospects for Our Future Vision

At the Nippon Soda Group, we celebrated our 100th anniversary in 2020. Ahead of the next 100 years, not only must we work to achieve our long-term vision, but it is also important that we look even further forward. To ensure our sustainable development and growth beyond FY 2030, which is the final year of our long-term vision, since 2021 we have continued work to enhance our research strategies. We are now targeting three new domains in which to set up new businesses and create new value so that we can achieve a sustainable society: Food (food tech), Healthcare (healthcare for people and animals), and Advanced Materials (next-generation ICT materials/carbon neutrality). Further, we have also begun a new employee training program to reinforce our technology marketing strategies. By improving our technology marketing capabilities, the aim is to create mechanisms whereby employees can independently propose their own themes. As one part of these efforts, in April 2022 we launched the New Business Planning and Development Department. By boosting our research strategies while incorporating objective viewpoints from consultants and other third parties, we will strive to create new businesses.

In creating new businesses, while there are no major issues regarding the in-house development of agro products, we believe that the development of chemical products requires proactive collaboration with external parties. While we will continue to place importance on our core technologies, we will not be able to achieve further growth without external influence, be it through M&As or industry-academia collaborations. Without relying on past achievements and by ridding ourselves of the idea that we are self-sufficient, we will promote various open innovation initiatives. Further, to make up for the reduction of our businesses due to structural reform, we will keep an eye on the proactive execution of M&As. When considering the need for synergy to expand our peripheral businesses, while M&As with Japanese companies might appear more beneficial, using my experience as one of the first resident employees when Nippon Soda purchased an overseas company, I hope to examine a range of other possibilities without limiting our scope to Japan. Moreover, while looking at both advantages and disadvantages, I will also do my best to learn from differences in operational approaches and corporate cultures.

We are also making progress with digital transformations as one business strategy to enhance our corporate value. In May 2022, we established a new production technology research building within the Nihongi Plant, installing the latest AI and computer-aided engineering facilities. In addition to examining optimal production models using computer simulations, the aim is to accumulate a range of technologies and expertise and apply them to our production sites. Meanwhile, as we aim to make use of materials informatics and other data science approaches, we are developing personnel who can learn and use the latest technologies and promote digitalization, and are digitalizing our research and development processes.

New research building, production technology research center, Nihongi Plant

Building a Sustainable Management Foundation to Contribute to Society

At Nippon Soda, we hope to enhance our human capital to create social value and achieve sustainable management. My wish is that all Nippon Soda employees can think and act independently. Rather than acting mechanically—for example by simply repeating a process from the previous year—I would like each employee to take the initiative and think, no matter how unique their ideas are. The approaches and values behind personnel systems and employment today are completely different to those I used to regard as unexceptional. For example, the idea that it is entirely normal for domestic sales staff to constantly relocate without their family would not be accepted in today’s society. At Nippon Soda, recently we have taken on the challenge of hiring individuals from completely different backgrounds, be it athletes or senior personnel with the skills and experience that we lack. I believe establishing environments and organizations that value diversity and allow diverse personnel to work while maximizing their capabilities are key to the generation of new innovations.

Moreover, as a result of our efforts to maintain and improve employees’ health, we have been recognized as a White 500 company for outstanding health and productivity management for five consecutive years. Meanwhile, in April 2022 we established the Health Management Promotion Section to further improve and establish health awareness among Nippon Soda Group employees. We have also adopted unassigned seating plans at the Head Office and set up free spaces to enhance dialogue among employees and provide opportunities for employees to share their values. In the future, we anticipate that working two concurrent jobs and other diverse workstyles will become the norm, and so we will look to incorporate a wide range of employment types such as work-from-home systems and fixed-location employment. By creating personnel systems that support diverse workstyles, we hope to be able to welcome personnel from the IT and DX sectors, where recruitment has traditionally been a challenge.

We are also working to sophisticate our governance as part of our efforts to reinforce our management foundation. Personally, as chair of the Board of Directors, I am placing particular emphasis on ensuring open communication among board members, including our outside directors. To ensure the thorough sharing of information, we have outside directors and full-time Audit and Supervisory Board members participate in Management Council meetings to offer their opinions on various matters. Following an evaluation of the effectiveness of the Board of Directors by an external organization, however, it was discovered that certain information was not shared with outside directors when they could not attend Management Council meetings, and so we have taken steps to address this issue by recording Management Council meetings and distributing the videos to our outside directors.

As a manufacturer of chemical products, we recognize that the creation of a sound material-cycle society is an important challenge. As such, we have joined the Carbon Neutrality Action Plan led independently by the Japan Business Federation (Keidanren), and we are introducing energy-efficient and energy-saving equipment, as well as taking energy-saving measures, to achieve targets for the reduction of CO2 emissions. We have also launched a logistics improvement project, reviewing logistics within our worksites and shortening lines of flow to reduce the amount of energy we use. Further, we use the Ministry of the Environment’s Basic Guidelines on Accounting for Greenhouse Gas (GHG) Emissions Throughout the Supply Chain to calculate GHG emissions from our business activities (Scopes 1 and 2) as well as indirect emissions from outside our business activities (Scope 3) to reduce emissions throughout the supply chain.

In research and development, through an industry-academia project with Rikkyo University, we have used our proprietary technologies to develop a metal organic framework (MOF) that can selectively adsorb CO2. As the newly developed MOF can store hydrogen molecules, we are looking at applying it to highly safe hydrogen storage cylinder. This newly developed MOF also has the potential to spread and promote the use of fuel cell vehicles. Elsewhere, our Group company Nisso Metallochemical Co., Ltd. is contributing to the creation of a sound material-cycle society through its recycling business. As we have achieved growth through our Responsible Care foundation, our desire to operate businesses that make major contributions to society will remain unchanged.

An Ever-growing Company That Is Widely Trusted by Society

To date, we have strived to conduct environmentally friendly business activities while responding to the expectations and trust placed in us by our shareholders, business partners, employees, communities, and various other stakeholders.

While we expect to see continued, drastic change in our social environment, our mission to contribute to society will remain constant, and we will make every effort to improve our corporate value. To do so, we will provide excellent products that contribute to society, implement business reform, and expand our high-added-value businesses. Developing a free and open organizational culture that enables employees to take on change is one of the most important roles for management. As a company that advocates social contributions, we will make steadfast efforts for the next 100 years. Looking ahead, we will make steady forward progress while steadily implementing the necessary initiatives to ensure we continue to be an organization that is indispensable to society.

We ask that you continue to look forward to the growth of the Nippon Soda Group. Thank you for your continued support.

Representative Director, President